Patti DiGangi, RDH, BS

As a navigator and long-time clinician, Patti guides audiences through the rough waters of coding. She believes dentistry is no longer just about fixing teeth; dentistry is oral medicine. Her efforts have assisted thousands of professionals to code more accurately and efficiently.

What are your top three most confusing perio codes? What’s the code for lasers and air-polishing? Is D0180 for perio charting? Are we required to use D4346? If a patient has localized SRP on the right, what is the code for the left? What code comes after D4346?

Or is it the eternal question: can we alternate D1110 with D4910? Many of you are already saying no, we can’t alternate. Sorry that response isn’t exactly accurate. I already hear you arguing – let me explain.

The D4910 code is for perio maintenance after surgical or non-surgical perio treatment. It’s not for patients with bone loss. We need to have the record of the previous treatment – for more details, read my previous post: Is It Perio or Preventive? Clearing Up the Codes.

There is an option, but first we need to understand remapping. Not a term most RDHs know, except you actually do know it as down-coding or up-coding. That’s changing a code to increase reimbursement. This can’t be done. A case for fraud could even be argued when a practice does this.

If you’re thinking, “insurance companies do this remapping all the time,” you’re once again correct. They can, we can’t. Now that’s not fair! Why can they but we can’t? (Do you hear me whining?) A carrier can because it’s based on a policy and $$. We can’t because it’s fraud for us to say we did something different than we actually did.

Increasingly dental practices have been down-coding. How? Since the addition of the D4346 code, offices have been choosing not to use it. Coding for the treatment we provide isn’t a choice. To choose a lesser code such as D1110 when D4346 treatment was provided is down-coding. Why would this be done? Because there may be a greater benefit paid for D1110.

Is the practice intentionally committing fraud? Whether by accident or ignorance, it’s still fraud. Even if the office has been doing it that way for a long time, it’s still fraud. Even when the carrier tells the patient or the office, it’s fraud.

Whew – got a little heavy there. Let me give you an easy way so this doesn’t happen.

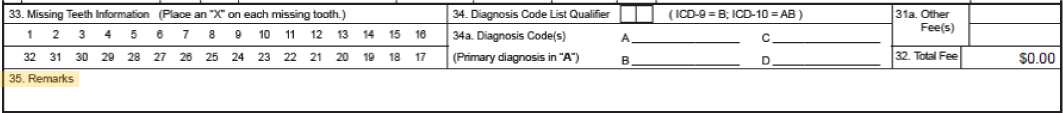

On the claim forms, Box 35 provides room for notes. As an RDH, you don’t see it, but it’s for “other” information to support the claim.

Here’s what you do: use the code that most accurately describes the treatment, and then on Box 35 these words can be added, “If no benefit available under Dxxxx, please consider alternative benefit.”

Presto, magic – this works. For alternating, it could read, “If no benefits available for D4910, please consider D1110.” For the gingivitis it reads, “If no benefit available for D4346, please consider D1110.”

The good news is you’re helping your patient and NOT committing fraud.

Submit a Comment